NDA-protected Financial Services Company

AI-powered Debt-Collection Assistant

Time:

2024

Team:

7

Industy:

AI

Engagement model:

Dedicated Team

Technology Stack

About the client

A financial services provider offering direct customer financing for small and medium-sized businesses (SMBs). The collections team was struggling with low engagement and high volumes of customer complaints.

Objectives

- Increase the rate of successful debt recovery.

- Reduce customer complaints and regulator escalations.

- Make the debt collection process smoother and less irritating for customers.

Solution

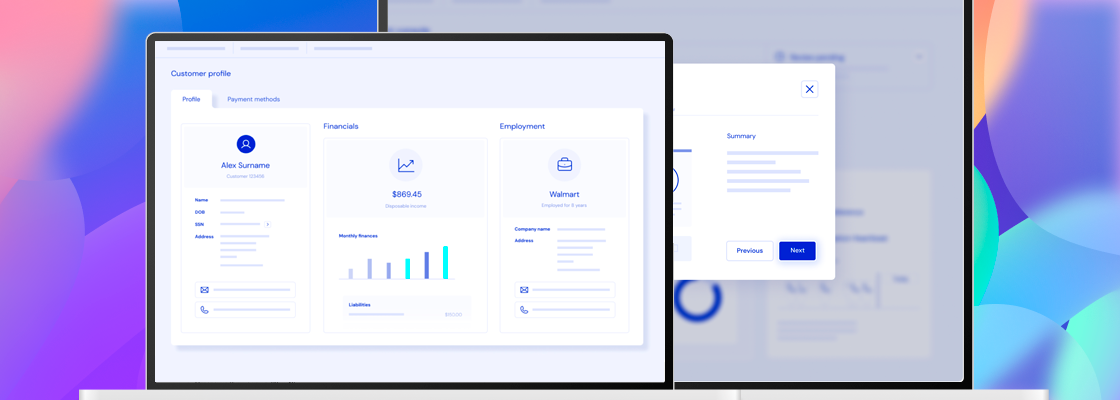

An AI-powered Debt-Collection Assistant was developed and integrated into the client’s operations.

Key Features:

- Behavior-based segmentation to determine the best communication channel, tone, and timing.

- An AI voice/chat agent capable of:negotiating promises-to-pay, waiving fees according to policy, capturing consent for card payments.

Results

- 2× increase in debt recovery rates

- 50% drop in customer complaints

- Significant reduction in regulator-related escalations

Business Value

The AI solution empowered the client to recover significantly more debt while reducing friction with customers. By automating time-consuming interactions and using behavioral data to guide outreach, the company improved operational efficiency, compliance, and customer satisfaction—all while maintaining full data security under NDA restrictions.