A confidential investment firm (under NDA)

AI-powered Early-Warning System

Technology Stack

About the client

A confidential investment firm (under NDA) offering credit to early- and growth-stage companies through structured lending. Portfolio managers needed a smarter way to identify loan risk early and prevent costly write-downs.

Objectives

Detect potential loan defaults before they surface in standard accounting reports.

Reduce manual analyst effort in monitoring loan performance.

Improve risk management through early intervention.

Solution

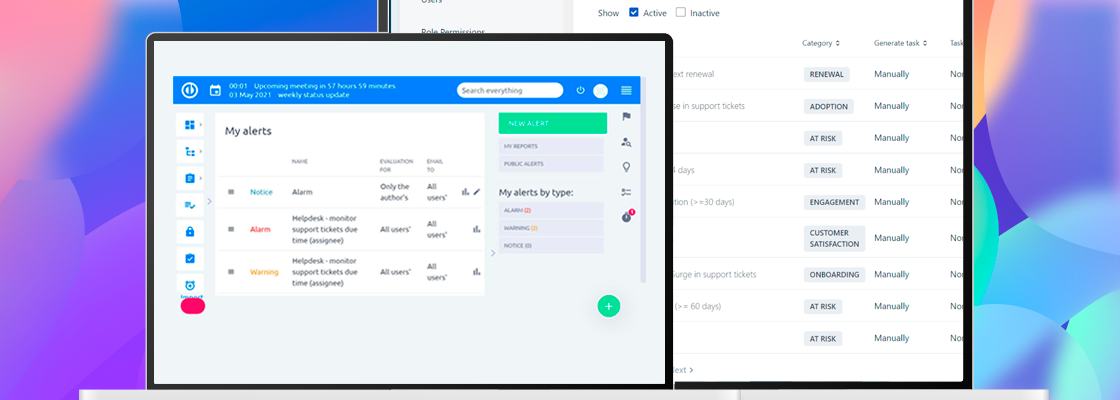

An AI-powered Early-Warning System was deployed to monitor and flag default risks in the loan portfolio in near real-time.

Key Features:

Ingests daily data from loan, collateral, and market sources.

Combines behavioral patterns (e.g., cash burn rate) with sentiment signals (e.g., social media analysis).

Produces dynamic probability-of-default scores and recommends next steps: issue waiver, request margin call, begin workout process

Flags any investees already in default to halt new funding initiatives.

Results

- Up to 30% more defaults flagged months earlier than traditional methods

- 90% reduction in analyst monitoring effort, freeing up time for high-value tasks

- Timely collateral negotiations prevented write-downs and preserved capital

Business Value

The AI early-warning system provided a significant edge in managing loan risk. By spotting signs of distress well before they appeared in accounting ledgers, the firm protected its portfolio, reduced reliance on reactive decisions, and enhanced investor confidence. Automated insights led to faster interventions, better capital preservation, and a leaner risk monitoring process.